№1 BANCASSURANCE PLATTFORM IN EUROPA

Effektive und benutzerfreundliche Versicherungslösungen für Banken und Versicherungsunternehmen.

№1 BANCASSURANCE PLATTFORM IN EUROPA

Effektive und benutzerfreundliche Versicherungslösungen für Banken und Versicherungsunternehmen.

ERFAHRENER PARTNER

FÜR LANGFRISTIGE KOOPERATIONEN

Mit über 15 Jahren Erfahrung und unserer hochmodernen Technologie-Infrastruktur unterstützen wir Sie tatkräftig in der Erreichung Ihrer Ziele.

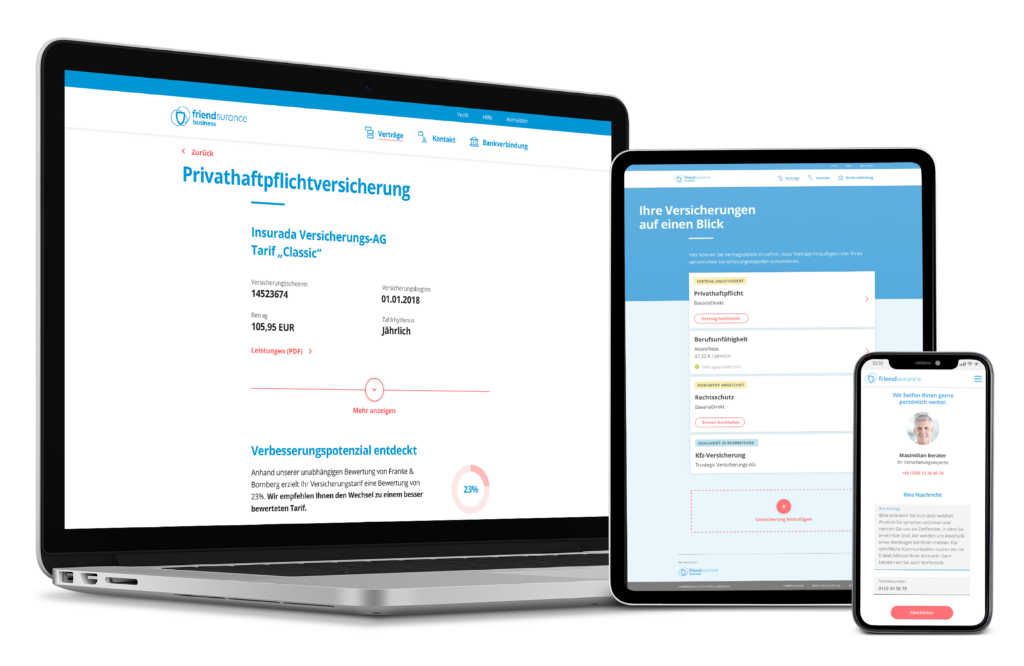

WIR ENTWICKELN DIGITALE

VERSICHERUNGSLÖSUNGEN

Automatische Überprüfung der Verträge & Leistungsvergleich

Transparente Übersicht aller Verträge

Unabhängige Beratung & Online-Terminvereinbarung

Wir glauben, dass der Umgang mit Versicherungen ein Lächeln ins Gesicht zaubern sollte.

Deshalb bauen wir die intuitivste Plattform und stellen den Kunden in den Mittelpunkt unseres Handelns.